CIMB Direct Debit Guide

DOKU has partnered with various banks and one of them is CIMB to provide Direct Debit Payment. Learn more about how DOKU can help you integrate with CIMB Direct Debit here.

Requirements

Before start integration, you must have retrieved credentials from CIMB.

If you don't have the credentials yet, we can help to facilitate you to get one. Here is the flow to get CIMB credentials:

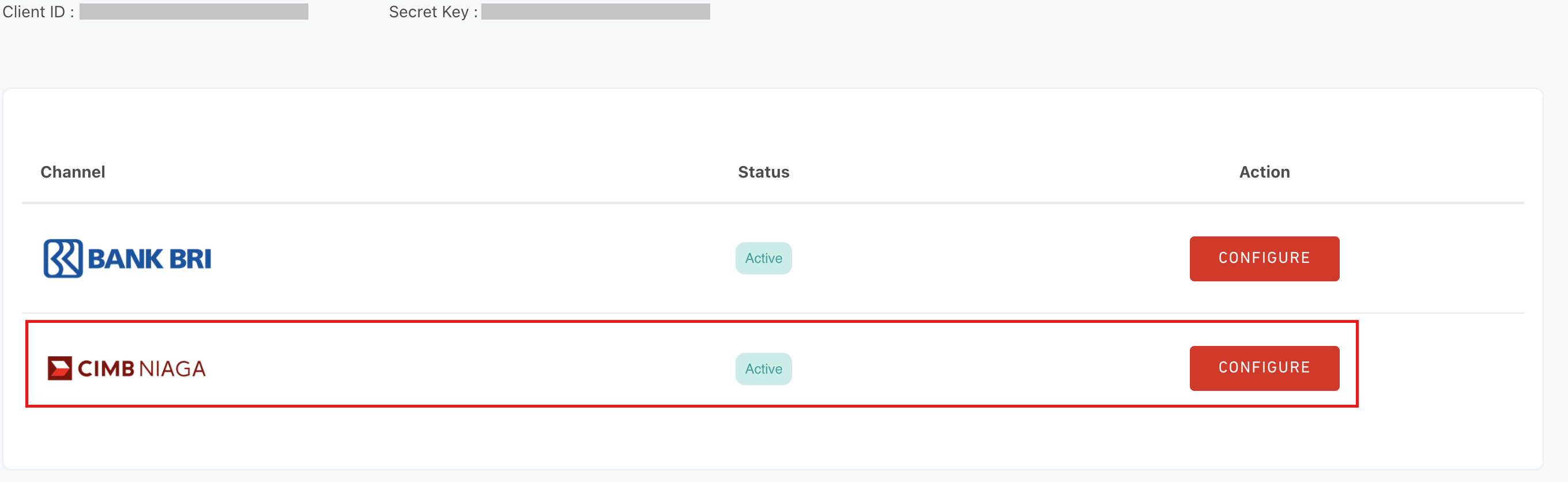

Direct API - CIMB Direct Debit Activation

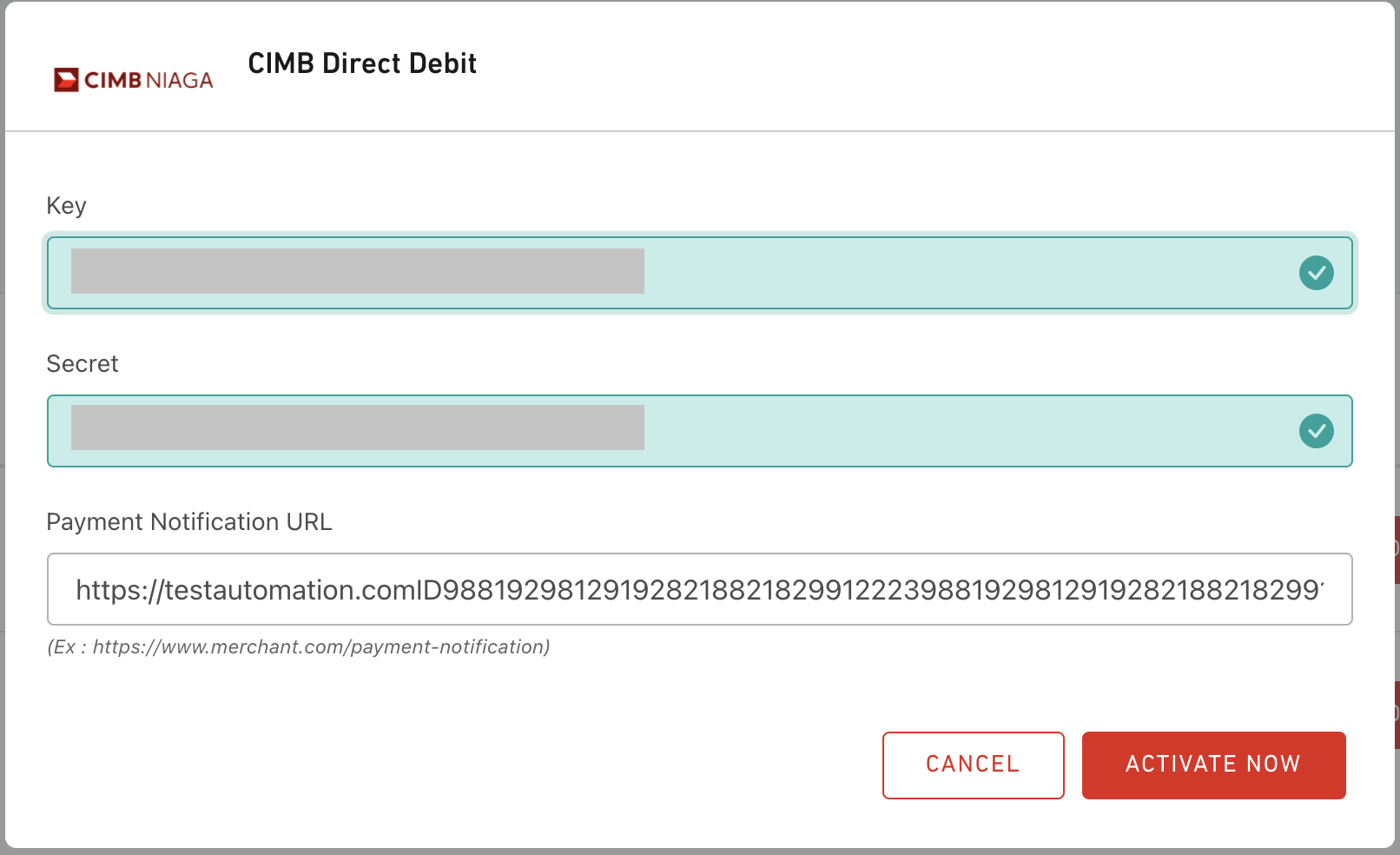

- Login to DOKU Back Office

- Go to Configuration > Direct Debit

- Select CIMB Direct Debit and click Activate button

- Input

Key - Input

Secret - Click Activate button

Congratulations! You are now ready for the integration.

Integration steps

Here is the overview of how to integrate with Direct Debit:

- Register Debit card (tokenization)

- Get token list

- Create payment using the token

- Acknowledge payment result

Optional but recommended to have:

- Resend OTP for payment

- Delete token

Advanced Features:

- Create Refund

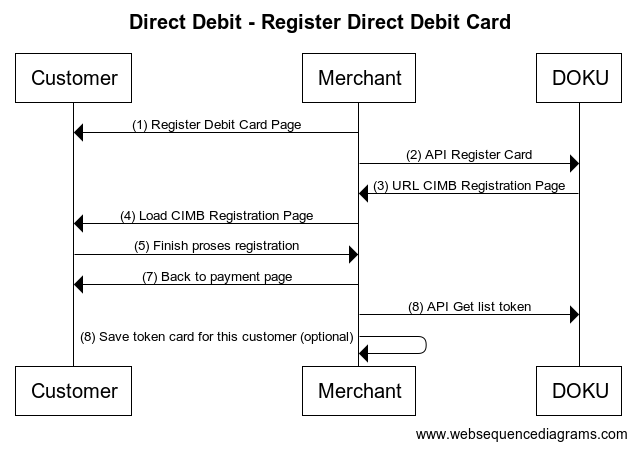

1. Register Debit card (tokenization)

Here is the flow for registering card:

Direct API - CIMB Direct Debit Register Card Sequence Diagram

To register the card, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/cimb-direct-debit/v1/token |

| API endpoint (Production) | https://api.doku.com/cimb-direct-debit/v1/token |

Here is the sample of request header to register the debit card:

Client-Id: MCH-0001-10791114622547

Request-Id: 672118bb-9963-43ce-93b2-26d4fd0732a3

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to register the debit card:

{

"customer": {

"id": "DOKUxCIMB_UAT_01",

"name": "TEST",

"email": "wtd@mail.com",

"phone": "6281394130621",

"id_card": "18291829918778",

"country": "Indonesia",

"address": "Jl. Menara Mulia",

"date_of_birth": "01-12-2000",

"additional_info": "None"

},

"debit_card": {

"account_email": "anton@example.com",

"account_mobile_phone":"6281394130621",

"success_registration_url":"https://jokul.doku.com/bo/login",

"failed_registration_url":"https://jokul.doku.com/bo/logixxx"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Unique customer identifier generated by merchant. Required to generate payment token. Allowed chars: alphabetic, numeric, special charsMax Length: 128 |

customer.name | string | Optional | Customer name Allowed chars: alphabeticMax Length: 64 |

customer.email | string | Optional | Customer email Allowed chars: alphabetic, numeric, special charsMax Length: 64 |

customer.phone | string | Optional | Customer phone number. Format: {calling_code}{phone_number}. Example: 6281122334455Allowed chars: numericMax Length: 32 |

customer.address | string | Optional | Customer address Allowed chars: alphabetic, numeric, special charsMax Length: 256 |

customer.country | string | Optional | 2 alphabetic country code ISO 3166-1 Allowed chars: alphabeticMin-max Length: 3 |

customer.id_card | string | Optional | Customer Identity Card number (KTP) for our risk engine assessment Allowed chars: alphabetic, numeric, special charsMax length: 32 |

customer.date_of_birth | string | Optional | Customer date of birth for our risk engine assesment Format: dd-MM-yyyy |

customer.additional_info | string | Optional | Customer additional info Max Length: 256 |

debit_card.account_email | string | Optional | Registered email on the CIMB |

debit_card.account_mobile_phone | string | Mandatory | Registered phone number on the CIMB. Format: {calling_code}{phone_number}.Example: 6281122334455Max Length: 20 |

debit_card.success_registration_url | string | Optional | URL for direct page after success register |

debit_card.failed_registration_url | string | Optional | URL for direct page after failed register |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 201 |

| Result | CREATED |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: 672118bb-9963-43ce-93b2-26d4fd0732a3

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"customer": {

"email": "wtd@mail.com",

"phone": "6281394130621",

"id_card": "18291829918778",

"country": "Indonesia",

"address": "Jl. Menara Mulia",

"date_of_birth": "01-12-2000",

"additional_info": "None",

"id": "DOKUxCIMB_36",

"name": "CIMB_DIRECTDEBIT08"

},

"debit_card": {

"cimb_registration_url": "https://alphaoctocash.cimbniaga.co.id/api-manager-external/alpha/direct-debit-web/register/a9e4c88c-a4ae-11ea-9682-0a1987d200002663",

"status": "PENDING",

"message": "Waiting for validated by CIMB"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

customer.email | string | Optional | Same as the request |

customer.phone | string | Optional | Same as the request |

customer.address | string | Optional | Same as the request |

customer.country | string | Optional | Same as the request |

customer.id_card | string | Optional | Same as the request |

customer.date_of_birth | string | Optional | Same as the request |

customer.additional_info | string | Optional | Same as the request |

debit_card.cimb_registration_url | string | Mandatory | url from CIMB for input rekening number |

debit_card.status | string | Mandatory | Token status. In this state, it should be PENDING |

debit_card.message | string | Mandatory | The token message according to debit.card.status |

2. Get token list

After the card is registered, you can show the token saved for your customer. This API also used to list down all the registered card, so that your customer does not need to register the card for the future payments.

To get the token list, you will to hit this API from your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/cimb-direct-debit/v1/tokens |

| API endpoint (Production) | https://api.doku.com/cimb-direct-debit/v1/tokens |

Here is the sample of request header to get the token list:

Client-Id: MCH-0001-10791114622547

Request-Id: 415f8064-ce1c-4c94-84b8-167201fd47cb

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to get the token list:

{

"customer": {

"id": "CIMBXDOKU112",

"name": "testing"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | The customer ID that has been registered to DOKU Allowed chars: alphabetic, numeric, special charsMax Length: 50 |

customer.name | string | Optional | The customer name that has been registered to DOKU Allowed chars: alphabeticMax Length: 70 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: 415f8064-ce1c-4c94-84b8-167201fd47cb

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

[

{

"customer": {

"id": "TEST-CIMBXDOKU-05",

"name": "DOKUXCIMB"

},

"debit_card": {

"token_id": "1614dc147e404f41f6d2de877fda1f94",

"account_no": "XXXXXXXX2800"

}

}

]

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

debit_card.token_id | string | Mandatory | Token generated by DOKU for the Debit card to use when do payment Max length: 128 |

debit_card.account_no | string | Mandatory | Last 4 digit of the Debit Card number |

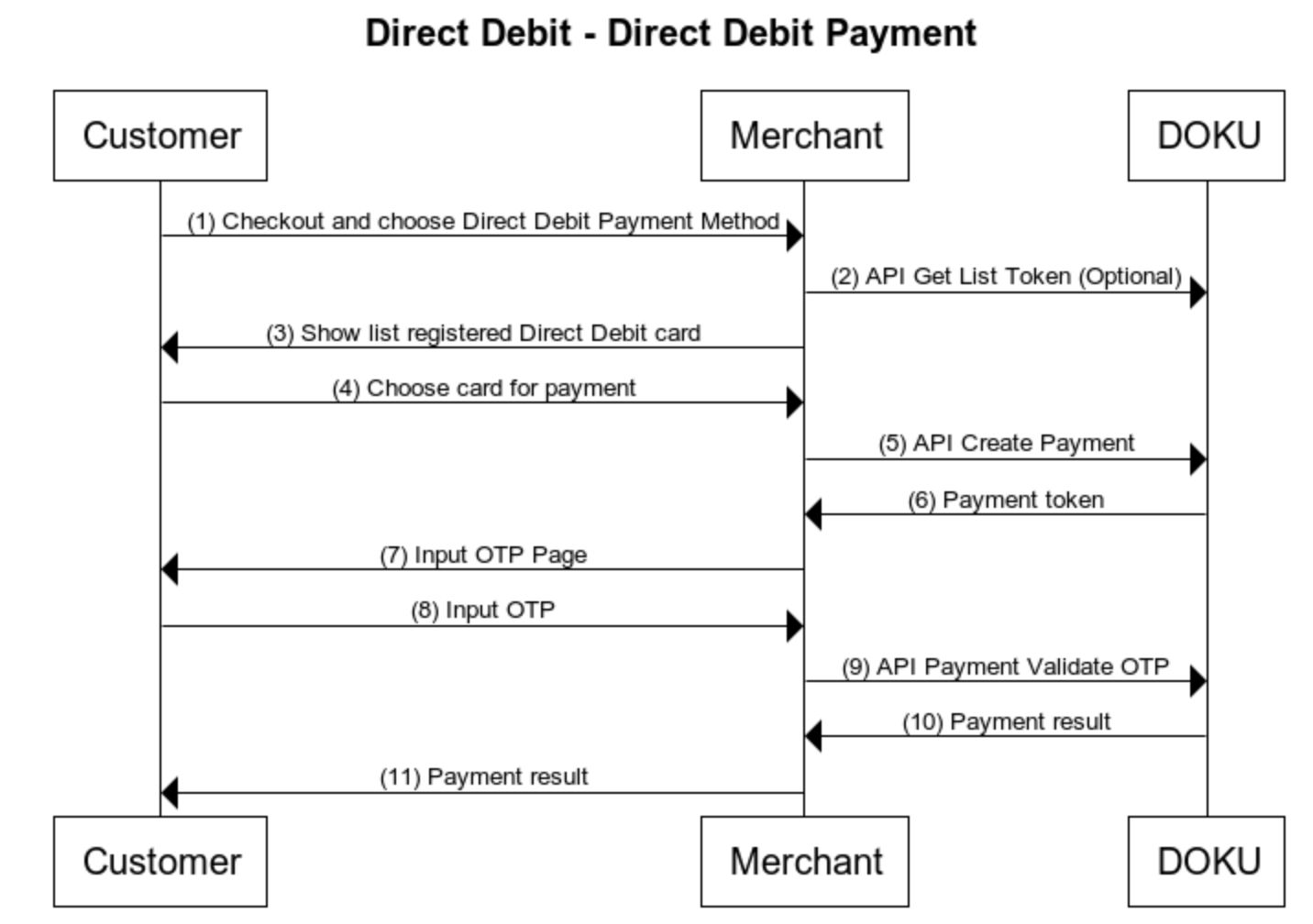

3. Create payment using the token

Here is the flow for creating payment using the token:

Direct API - CIMB Direct Debit Payment Sequence Diagram

To create the payment, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/cimb-direct-debit/v1/payment |

| API endpoint (Production) | https://api.doku.com/cimb-direct-debit/v1/payment |

Here is the sample of request header to create the payment:

Client-Id: MCH-0001-10791114622547

Request-Id: b6a465ea-bb65-48b2-a22b-3e8fb51cf22e

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to create the payment:

{

"customer": {

"id": "DOKUxCIMB_UAT_05",

"name": "Robby",

"phone": "628817219910",

"email": "wtd@mail.com",

"id_card": "18291829918778",

"country": "Indonesia",

"address": "Jl. Menara Mulia",

"date_of_birth": "01-12-2000"

},

"additional_info": {

"message": "no additional info",

"test": "test"

},

"order": {

"invoice_number": "INV_NUMBER_D005",

"line_items": [

{

"name": "Vitamin C",

"price": 40000,

"quantity": 1

},

{

"name": "Pensil Warna",

"price": 50000,

"quantity": 1

}

],

"amount": 20000,

"session_id": "SESSION-ID-001"

},

"payment": {

"token_id": "287a73836d2d611990affce3b1affc3a",

"otp_expiration_timestamp": 360010

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | The customer ID that has been registered to DOKU Allowed chars: alphabetic, numeric, special charsMax Length: 50 |

customer.name | string | Optional | The customer name that has been registered to DOKU Allowed chars: alphabeticMax Length: 70 |

customer.email | string | Optional | Customer email Allowed chars: alphabetic, numeric, special charsMax Length: 64 |

customer.phone | number | Optional | Customer phone number. Format: {calling_code}{phone_number}. Example: 6281122334455Allowed chars: numericMax Length: 20 |

customer.address | string | Optional | Customer address Allowed chars: alphabetic, numeric, special charsMax Length: 255 |

customer.country | string | Optional | 2 alphabetic country code ISO 3166-1 Allowed chars: alphabeticMin-max Length: 60 |

customer.id_card | string | Optional | Customer Identity Card number (KTP) for our risk engine assessment Allowed chars: alphabetic, numeric, special charsMax length: 20 |

customer.date_of_birth | string | Optional | Customer date of birth for our risk engine assesment Format: dd-MM-yyyy |

additional_info.message | string | Optional | Additional info message |

additional_info.test | string | Optional | Additional info test |

order.invoice_number | string | Mandatory | Generated by merchant to identify the order Allowed chars: alphabetic, numeric, special chars Max length: 64 |

order.line_items.name | string | Optional | Name of the product item, privacy concern so optional, but if send will help our risk engine Allowed chars: alphabetic, numeric, special chars |

order.line_items.price | number | Optional | Price of the product item, privacy concern so optional, but if send will help our risk engine Total price and quantity must match with the order.amountAllowed chars: numeric |

order.line_items.quantity | number | Optional | Quantity of the product item, privacy concern so optional, but if send will help our risk engine Allowed chars: numeric |

order.amount | number | Mandatory | In IDR Currency and without decimal, and converted total amount. Allowed chars: numericMax length: 12 |

order.session_id | string | Optional | Transaction session id Allowed chars: Alphabetic,numeric, special charsMax length: 50 |

payment.token_id | string | Mandatory | The token that will be use for this transaction Max length: 128 |

payment.otp_expiration_timestamp | number | Optional | OTP expiration time in minute Default: 10 minutes |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 201 |

| Result | CREATED |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: b6a465ea-bb65-48b2-a22b-3e8fb51cf22e

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"customer": {

"id": "DOKUxCIMB_30",

"name": "CIMB_DIRECTDEBIT08",

"email": "wtd@mail.com",

"phone": "6281394130621",

"id_card": "18291829918778",

"country": "Indonesia",

"address": "Jl. Menara Mulia",

"date_of_birth": "01-12-2000",

"additional_info": "None"

},

"order": {

"invoice_number": "INV_NUMBER_D009",

"line_items": [

{

"name": "Vitamin C",

"price": "40000",

"quantity": "1"

},

{

"name": "Pensil Warna",

"price": "50000",

"quantity": "1"

}

],

"amount": "90000",

"session_id": "SESSION-ID-001"

},

"payment": {

"token": "M8L5TfWSxN6orwBlpqaZi3zMuElXH3J9xERWGqtT4",

"status": "PENDING"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

customer.email | string | Optional | Same as the request |

customer.phone | string | Optional | Same as the request |

customer.address | string | Optional | Same as the request |

customer.country | string | Optional | Same as the request |

customer.id_card | string | Optional | Same as the request |

customer.date_of_birth | string | Optional | Same as the request |

order.amount | number | Mandatory | Same as the request |

order.session_id | string | Optional | Transaction session id Allowed chars: Alphabetic,numeric, special charsMax length: 50 |

order.invoice_number | string | Mandatory | Same as the request |

order.line_items.name | string | Optional | Same as the request |

order.line_items.price | number | Optional | Same as the request |

order.line_items.quantity | number | Optional | Same as the request |

payment.token | string | Mandatory | Payment token generated by DOKU specific for the transaction |

payment.status | string | Mandatory | PENDING for successful token request (waiting for OTP verification) / SUCCESS if not need OTP |

3.1. Validate payment OTP

Now the payment is created but the status is PENDING. CIMB will send the OTP to the customers and you will need to provide the form to let the customer input the OTP.

To validate the OTP, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/cimb-direct-debit/v1/payment/validate |

| API endpoint (Production) | https://api.doku.com/cimb-direct-debit/v1/payment/validate |

Here is the sample of request header to validate the OTP:

Client-Id: MCH-0001-10791114622547

Request-Id: bce963fc-bb93-4ef2-948a-7838044b537e

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to validate the OTP:

{

"payment":{

"token":"xLvT3bQrGq65xbTrfhlaEP6R5qiazxJjkbsaxQ421Nc",

"otp":"999999"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

payment.token | string | Mandatory | The token that generated by DOKU for the transaction Max length: 256 |

payment.otp | string | Mandatory | The Payment OTP that sent by the CIMB to the customer Max length: 6 Notes : OTP from CIMB will expired in 5 minutes |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: bce963fc-bb93-4ef2-948a-7838044b537e

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"customer": {

"id": "DOKUxCIMB_30",

"name": "CIMB_DIRECTDEBIT08",

"email": "wtd@mail.com",

"phone": "6281394130621",

"id_card": "18291829918778",

"country": "Indonesia",

"address": "Jl. Menara Mulia",

"date_of_birth": "01-12-2000",

"additional_info": "None"

},

"order": {

"invoice_number": "INV_NUMBER_D009",

"line_items": [

{

"name": "Vitamin C",

"price": "40000",

"quantity": "1"

},

{

"name": "Pensil Warna",

"price": "50000",

"quantity": "1"

}

],

"amount": "90000.00"

},

"payment": {

"payment_id": "001194654652",

"token": "xLvT3bQrGq65xbTrfhlaEP6R5qiazxJjkbsaxQ421Nc",

"status": "SUCCESS"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

customer.email | string | Optional | Same as the request |

customer.phone | string | Optional | Same as the request |

customer.address | string | Optional | Same as the request |

customer.country | string | Optional | Same as the request |

customer.id_card | string | Optional | Same as the request |

customer.date_of_birth | string | Optional | Same as the request |

customer.additional_info | string | Optional | Same as the request |

order.amount | number | Mandatory | Same as the request |

order.invoice_number | string | Mandatory | Same as the request |

order.line_items.name | string | Optional | Same as the request |

order.line_items.price | number | Optional | Same as the request |

order.line_items.quantity | number | Optional | Same as the request |

payment.payment_id | string | Mandatory | Payment ID from the Bank |

payment.token | string | Mandatory | Same as the request |

payment.status | string | Mandatory | Payment status. In this state, it should be SUCCESS or FAILED |

4. Acknowledge payment result

After the payment is being made by your customer, DOKU will send HTTP Notification to your defined Notification URL. Learn how to handle the notification from DOKU:

Additional Features

These are the feature that recommended to implement to make sure that you deliver a good payment experience for your customers.

1. Resend OTP for payment

If for some reasons, your customers didn't receive the OTP when doing a payment. You can use this API to resend new OTP.

To resend the new OTP for payment, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/cimb-direct-debit/v1/payment-otp |

| API endpoint (Production) | https://api.doku.com/cimb-direct-debit/v1/payment-otp |

Here is the sample of request header to resend the OTP for payment:

Client-Id: MCH-0001-10791114622547

Request-Id: ea41603d-8f77-43ba-9dc3-def0766fe69b

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to resend the OTP for payment:

{

"payment": {

"token":"?UiUVuLzrkuHzIZmKMkAMRU5yPI4x19utIF93ekkz0"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

payment.token | string | Mandatory | Payment token generated by DOKU specific for the transaction. The token valid for 2.5 minutes |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: ea41603d-8f77-43ba-9dc3-def0766fe69b

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"payment": {

"token":"?UiUVuLzrkuHzIZmKMkAMRU5yPI4x19utIF93ekkz0"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

payment.token | string | Mandatory | Same as the request |

2. Delete the token

If for some reasons, your cutomers want to remove the card from your application, then you will need to provide this feature.

To delete the token, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/cimb-direct-debit/v1/token-delete |

| API endpoint (Production) | https://api.doku.com/cimb-direct-debit/v1/token-delete |

Here is the sample of request header to delete the token:

Client-Id: MCH-0001-10791114622547

Request-Id: c8154b5b-25fa-430d-9e5f-5a8a34d6d371

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to resend the OTP for payment:

{

"customer": {

"id": "CIMBXDOKU112",

"name": "Anton Budiman"

},

"debit_card": {

"token_id": "b21acc29d08750fa4d9f3eda77089352"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | The customer ID that has been registered to DOKU Allowed chars: alphabetic, numeric, special charsMax Length: 50 |

customer.name | string | Optional | The customer name that has been registered to DOKU Allowed chars: alphabeticMax Length: 70 |

debit_card.token_id | string | Mandatory | Token generated by DOKU for the Debit card to use when do payment Max length: 128 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: c8154b5b-25fa-430d-9e5f-5a8a34d6d371

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"customer": {

"id": "TEST-CIMBXDOKU-05",

"name": "DOKUXCIMB"

},

"debit_card": {

"token_id": "1614dc147e404f41f6d2de877fda1f94",

"status": "SUCCESS",

"message": "Success Unbinding Card"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

debit_card.token_id | string | Mandatory | Same as the request |

debit_card.status | string | Mandatory | The unbinding card status Possible value: SUCCESS, FAILED |

debit_card.message | string | Mandatory | The message to indicates that the card has been unbinded and merchant can safely revoke the card |

3. Refund

To request a refund, you will need to hit this API through your backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/cimb-direct-debit/v1/payment-refund |

| API endpoint (Production) | https://api.doku.com/cimb-direct-debit/v1/payment-refund |

Here is the sample of request header to generate payment URL:

Client-Id: MCH-0001-10791114622547

Request-Id: 6cc9f8b1-d83d-4c24-b853-a3223f43a744

Request-Timestamp: 2020-08-12T09:45:42Z

Signature: HMACSHA256=9UPUFzOqJc47aJzD9ESOTcWg6TMsg3mqSP+DnUO8ENE=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample request body to request a refund:

{

"order": {

"invoice_number": "INV_NUMBER_D006"

},

"payment": {

"original_request_id":"2620"

},

"refund": {

"amount":"2000",

"reason":"Cancel Order"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

order.invoice_number | string | Mandatory | Invoice number of the transaction that being refunded |

payment.original_request_id | string | Mandatory | Original Payment Request Id that want to refunded |

refund.amount | number | Mandatory | Transaction amount that wants to be refunded |

refund.reason | string | Optional | Get from payment notification response |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 201 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: 6cc9f8b1-d83d-4c24-b853-a3223f43a744

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"order": {

"invoice_number": "INV_NUMBER_D009"

},

"payment": {

"original_request_id": "82014",

"payment_id": "001799101960"

},

"refund": {

"amount": 1000,

"reason": "Cancel Order",

"status": "SUCCESS",

"message": "SUCCESS"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

order.invoice_number | string | Mandatory | Same as the request |

payment.original_request_id | string | Same as the request | |

refund.amount | number | Mandatory | Same as the request |

refund.reason | string | Optional | Same as the request |

refund.status | string | Optional | Refund status Possible Value : SUCCESS or FAILED |

refund.message | string | Optional | Reason if failed refund |

Tokenization

Want to make your checkout experience faster? You can combine this integration with the Tokenization, so the next time your customer purchase, they don't need to input the debit card anymore.

Split Settlement

If you are a platform or a marketplace, you can use this feature to settle the funds to your sellers or partners programmatically, save many operational efforts.