Bank Mandiri VA Guide

DOKU has partnered with various banks and one of them is Mandiri to provide Virtual Account Payment. Learn more about how DOKU can help you integrate with Mandiri Virtual Account here.

Mandiri VA Payment Method activation

We offered two types of Mandiri VA activation:

- Aggregator Model

- Direct Model

Aggregator model means you will use DOKU BIN and if you have your own BIN from Mandiri, you can use the Direct Model

What is BIN?

BIN stands for Bank Identifier

Integration methods

There are two methods to integrate with Mandiri VA:

- Register: The VA number will be registered to DOKU and Acquirer will inquiry to our side when the customer make payment at the acquirer channel (ATM, mobile banking, internet banking, etc.)

- DOKU Generated VA: The VA number is generated by DOKU. Suitable for e-commerce business model.

- Merchant Generated VA: The VA number is generated by Merchant. Suitable for top up business model.

- Direct Inquiry (DIPC): The VA number is registered on merchant side and DOKU will forward Acquirer inquiry request to merchant side when the customer make payment at the acquirer channel (ATM, mobile banking, internet banking, etc.)

Integration steps

- DOKU Generate VA

- Merchant Generate VA

- Direct Inquiry

Here is the overview of how to integrate with Virtual Account:

- Generate payment code (virtual account number)

- Display payment code (virtual account number)

- Acknowledge payment result

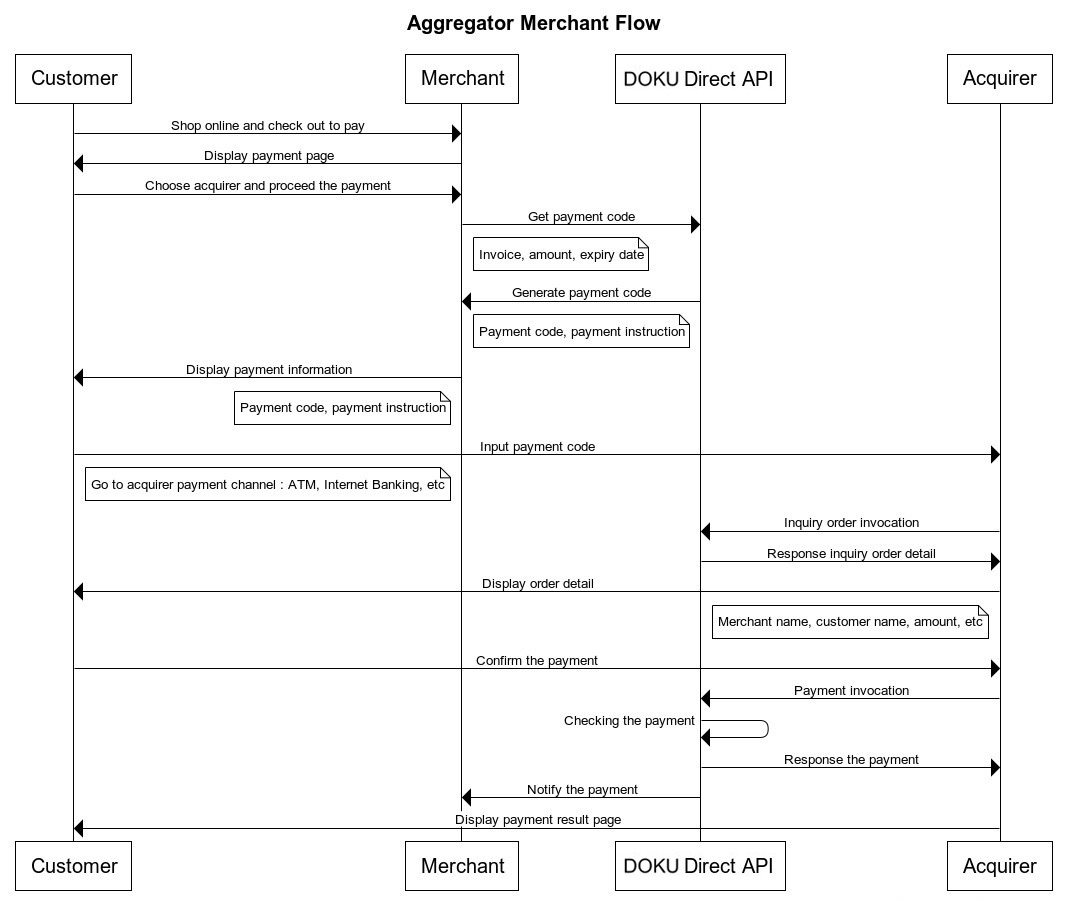

Direct API - DOKU Generated Payment Code Virtual Account Sequence Diagram

1. Generate payment code (virtual account number)

To generate payment code, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/mandiri-virtual-account/v2/payment-code |

| API endpoint (Production) | https://api.doku.com/mandiri-virtual-account/v2/payment-code |

Here is the sample of request header to generate payment code:

Client-Id: MCH-0001-10791114622547

Request-Id: cc682442-6c22-493e-8121-b9ef6b3fa728

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to generate payment code:

{

"order": {

"invoice_number": "INV-20210124-0001",

"amount": 150000

},

"virtual_account_info": {

"billing_type": "FIX_BILL",

"expired_time": 60,

"reusable_status": false,

"info1": "Merchant Demo Store",

"info2": "Thank you for shopping",

"info3": "on our store"

},

"customer": {

"name": "Anton Budiman",

"email": "anton@example.com"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

order.invoice_number | string | Mandatory | Generated by merchant to identify the order and must unique per request Allowed chars: alphabetic, numeric, special chars Max length: 64 |

order.amount | number | Conditional | In IDR currency and without decimal. Set this parameter to more than (>) 0 for Close Amount Virtual AccountAllowed chars: numericMax length: 12 |

order.min_amount | number | Conditional | Send this parameter for Limited Amount Virtual Account to set the minimum amount need to be paid by the customer Allowed chars: numericMax length: 12 |

order.max_amount | number | Conditional | Send this parameter for Limited Amount Virtual Account to set the maximum amount need to be paid by the customer Allowed chars: numericMax length: 12 |

virtual_account_info.billing_type | string | Optional | Generated by Merchant to implement the open amount, close amount and limit amount features. For open amount, set this to NO_BILL. For close amount, set this to FIX_BILLPossible Value : FIX_BILL, NO_BILL Default value: FIX_BILL |

virtual_account_info.expired_time | number | Optional | Virtual account expiration time in minutes format Allowed chars: numericMaximum length: 5Default value: 60 |

virtual_account_info.reusable_status | number | Mandatory | For VA that can be paid more than once, set this to truePossible value: true false |

virtual_account_info.info1 | string | Optional | Additional info that will be display on the acquirer channel (eg. ATM, Internet Banking) when customer do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 32 |

virtual_account_info.info2 | string | Optional | Additional info that will be display on the acquirer channel (eg. ATM, Internet Banking) when customer do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 32 |

virtual_account_info.info3 | string | Optional | Additional info that will be display on the acquirer channel (eg. ATM, Internet Banking) when customer do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 32 |

customer.name | string | Mandatory | Customer name that will be displayed on acquirer channel when do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 64 |

customer.email | string | Optional | Customer email Allowed chars: alphabetic, numeric, special charsMax length: 128 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Client-Id: MCH-0001-10791114622547

Request-Id: cc682442-6c22-493e-8121-b9ef6b3fa728

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=9UPUFzOqJc47aJzD9ESOTcWg6TMsg3mqSP+DnUO8ENE=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"order": {

"invoice_number": "INV-20210124-0001"

},

"virtual_account_info": {

"virtual_account_number": "8889940000000213",

"how_to_pay_page": "https://sandbox.doku.com/how-to-pay/v1/mandiri-virtual-account/8889940000000213",

"how_to_pay_api": "https://sandbox.doku.com/mandiri-virtual-account/v1/how-to-pay-api/8889940000000213",

"created_date": "20200313095850",

"expired_date": "20200313155850"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

order.invoice_number | string | Mandatory | Same as the request |

virtual_account_info.virtual_account_number | string | Mandatory | Generated by DOKU that will be used by customer for doing a payment through acquirer channel (eg. ATM, Internet Banking) |

virtual_account_info.how_to_pay_page | string | Optional | Page URL that merchant can use to display how customer can complete the payment process through acquirer channel (eg. ATM, Internet Banking) |

virtual_account_info.how_to_pay_api | string | Optional | URL that merchant can parse to display customized how customer can complete the payment process through accquirer channel (eg. ATM, Internet Banking) |

virtual_account_info.created_date | string | Mandatory | Date time of VA generated with the format of yyyyMMddHHmmss. The created date uses UTC+7 time |

virtual_account_info.expired_date | string | Mandatory | Date time of VA will be expired with the format of yyyyMMddHHmmss. The expired date uses UTC+7 time. Use this to set the expiry order on merchant side |

Pro Tips

You can also show payment instruction link to your customer by using virtual_account_info.how_to_pay_page. If you wish to customize the UI for the payment instruction, you can use the virtual_account_info.how_to_pay_api.

2. Display payment code (virtual account number)

You can display the payment code to your customer by using virtual_account_info.virtual_account_number that you retrieved from the API response.

3. Acknowledge payment result

After the payment is being made by your customer, DOKU will send HTTP Notification to your defined Notification URL. Learn how to handle the notification from DOKU:

Here is the overview of how to integrate with Virtual Account:

- Generate payment code (virtual account number)

- Display payment code (virtual account number)

- Acknowledge payment result

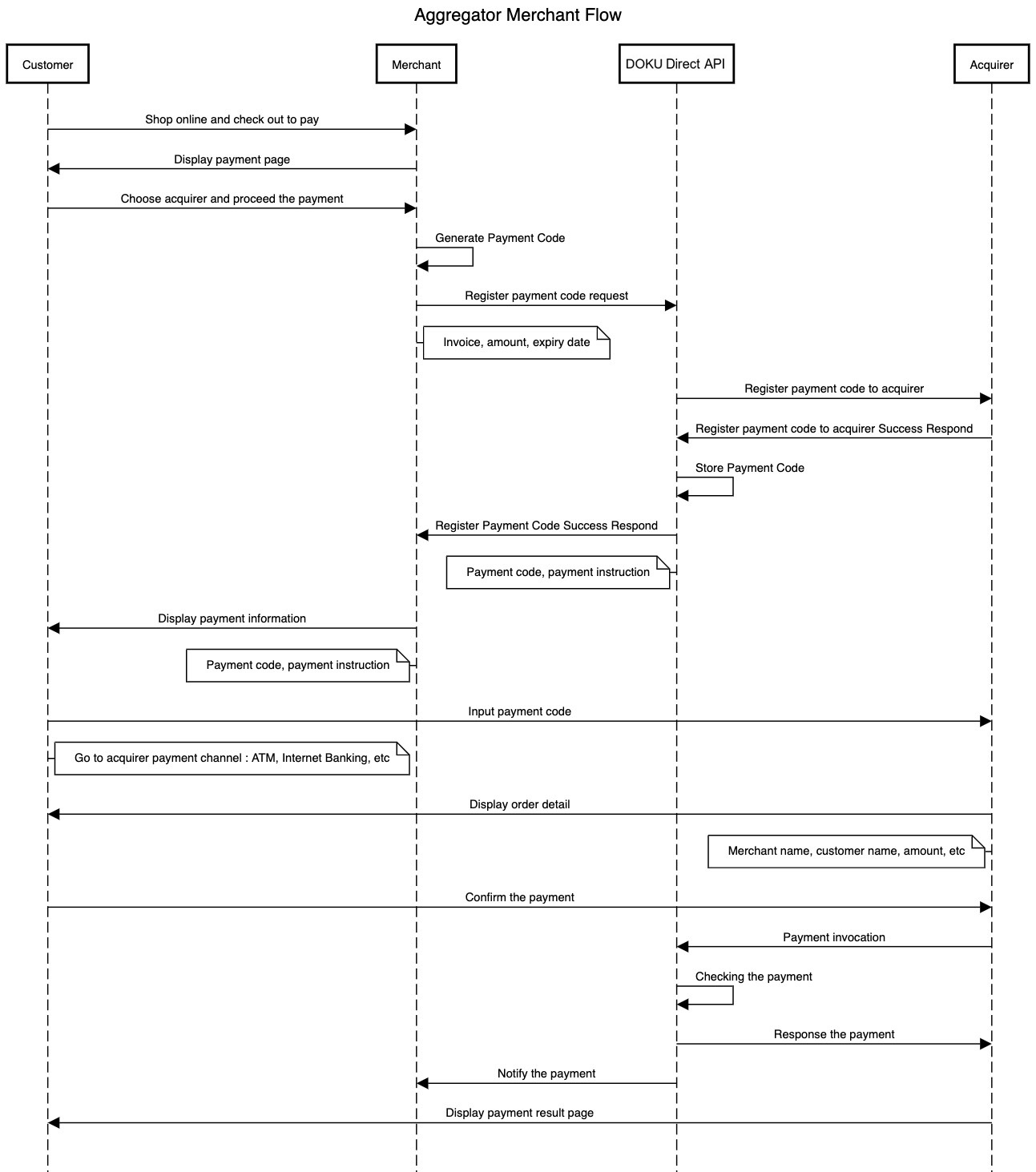

Direct API - Merchant Generated Payment Code Virtual Account Sequence Diagram

1. Generate payment code (virtual account number)

To generate payment code, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/mandiri-virtual-account/v2/merchant-payment-code |

| API endpoint (Production) | https://api.doku.com/mandiri-virtual-account/v2/merchant-payment-code |

Here is the sample of request header to generate payment code:

Client-Id: MCH-0001-10791114622547

Request-Id: cc682442-6c22-493e-8121-b9ef6b3fa728

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to generate payment code:

{

"order": {

"invoice_number": "invoice-0000061212314",

"amount": 10000

},

"virtual_account_info": {

"virtual_account_number": "888994987654322",

"billing_type": "FIX_BILL",

"expired_time": 60,

"reusable_status": false,

"info1": "Online Shoping Store",

"info2": "Online Shoping Store",

"info3": "Online Shoping Store"

},

"customer": {

"name": "Anton Budiman",

"email": "anton@example.com"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

order.invoice_number | string | Mandatory | Generated by merchant to identify the order and must unique per request Allowed chars: alphabetic, numeric, special chars Max length: 64 |

order.amount | number | Conditional | In IDR currency and without decimal. Set this parameter to more than (>) 0 for Close Amount Virtual AccountAllowed chars: numericMax length: 12 |

order.min_amount | number | Conditional | Send this parameter for Limited Amount Virtual Account to set the minimum amount need to be paid by the customer Allowed chars: numericMax length: 12 |

order.max_amount | number | Conditional | Send this parameter for Limited Amount Virtual Account to set the maximum amount need to be paid by the customer Allowed chars: numericMax length: 12 |

virtual_account_info.virtual_account_number | number | Mandatory | Generated by Merchant that will be used by customer for doing a payment through acquirer channel (eg. ATM, Internet Banking) Max Length : 16 |

virtual_account_info.billing_type | string | Optional | Generated by Merchant to implement the open amount, close amount and limit amount features. For open amount, set this to NO_BILL. For close amount, set this to FIX_BILLPossible Value : FIX_BILL, NO_BILL Default value: FIX_BILL |

virtual_account_info.expired_time | number | Optional | Virtual account expiration time in minutes format Allowed chars: numericMaximum length: 8Default value: 60 |

virtual_account_info.reusable_status | string | Mandatory | For VA that can be paid more than once, set this to truePossible value: true false |

virtual_account_info.info1 | string | Optional | Additional info that will be display on the acquirer channel (eg. ATM, Internet Banking) when customer do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 32 |

virtual_account_info.info2 | string | Optional | Additional info that will be display on the acquirer channel (eg. ATM, Internet Banking) when customer do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 32 |

virtual_account_info.info3 | string | Optional | Additional info that will be display on the acquirer channel (eg. ATM, Internet Banking) when customer do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 32 |

customer.name | string | Mandatory | Customer name that will be displayed on acquirer channel when do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 64 |

customer.email | string | Optional | Customer email Allowed chars: alphabetic, numeric, special charsMax length: 128 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Client-Id: MCH-0001-10791114622547

Request-Id: cc682442-6c22-493e-8121-b9ef6b3fa728

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=9UPUFzOqJc47aJzD9ESOTcWg6TMsg3mqSP+DnUO8ENE=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"order": {

"invoice_number": "invoice-0000061212314"

},

"virtual_account_info": {

"virtual_account_number": "888994987654322",

"how_to_pay_page": "https://app-uat.doku.com/how-to-pay/v2/mandiri-virtual-account/888994987654322/Nu1Da8fdXbFDcLTpJ37uRrv25oJJqB9sbTI64yp1KKo",

"how_to_pay_api": "https://app-uat.doku.com/mandiri-virtual-account/v2/how-to-pay-api/888994987654322/Nu1Da8fdXbFDcLTpJ37uRrv25oJJqB9sbTI64yp1KKo",

"created_date": "20210907113621",

"expired_date": "20210907123621",

"created_date_utc": "2021-09-07T04:36:21Z",

"expired_date_utc": "2021-09-07T05:36:21Z"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

order.invoice_number | string | Mandatory | Same as the request |

virtual_account_info.virtual_account_number | number | Mandatory | Generated by Merchant that already registered to DOKU and will be used by customer for doing a payment through acquirer channel (eg. ATM, Internet Banking) |

virtual_account_info.how_to_pay_page | string | Optional | Page URL that merchant can use to display how customer can complete the payment process through acquirer channel (eg. ATM, Internet Banking) |

virtual_account_info.how_to_pay_api | string | Optional | URL that merchant can parse to display customized how customer can complete the payment process through accquirer channel (eg. ATM, Internet Banking) |

virtual_account_info.created_date | number | Conditional | Date time of VA generated with the format of yyyyMMddHHmmss. The created date uses UTC+7 time |

virtual_account_info.expired_date | string | Conditional | Date time of VA will be expired with the format of yyyyMMddHHmmss. The expired date uses UTC+7 time. Use this to set the expiry order on merchant side |

virtual_account_info.created_date_utc | string | Conditional | Date time of VA generated in UTC format |

virtual_account_info.expired_date_utc | string | Conditional | Date time of VA will be expired in UTC. Use this to set the expiry order on merchant side |

Pro Tips

You can also show payment instruction link to your customer by using virtual_account_info.how_to_pay_page. If you wish to customize the UI for the payment instruction, you can use the virtual_account_info.how_to_pay_api.

2. Display payment code (virtual account number)

You can display the payment code to your customer by using virtual_account_info.virtual_account_number that you retrieved from the API response.

3. Acknowledge payment result

After the payment is being made by your customer, DOKU will send HTTP Notification to your defined Notification URL. Learn how to handle the notification from DOKU:

Here is the overview of how to integrate with Mandiri:

- Setup

Inquiry URL - Generate payment code

- Receive inquiry request from DOKU

- Acknowledge payment result

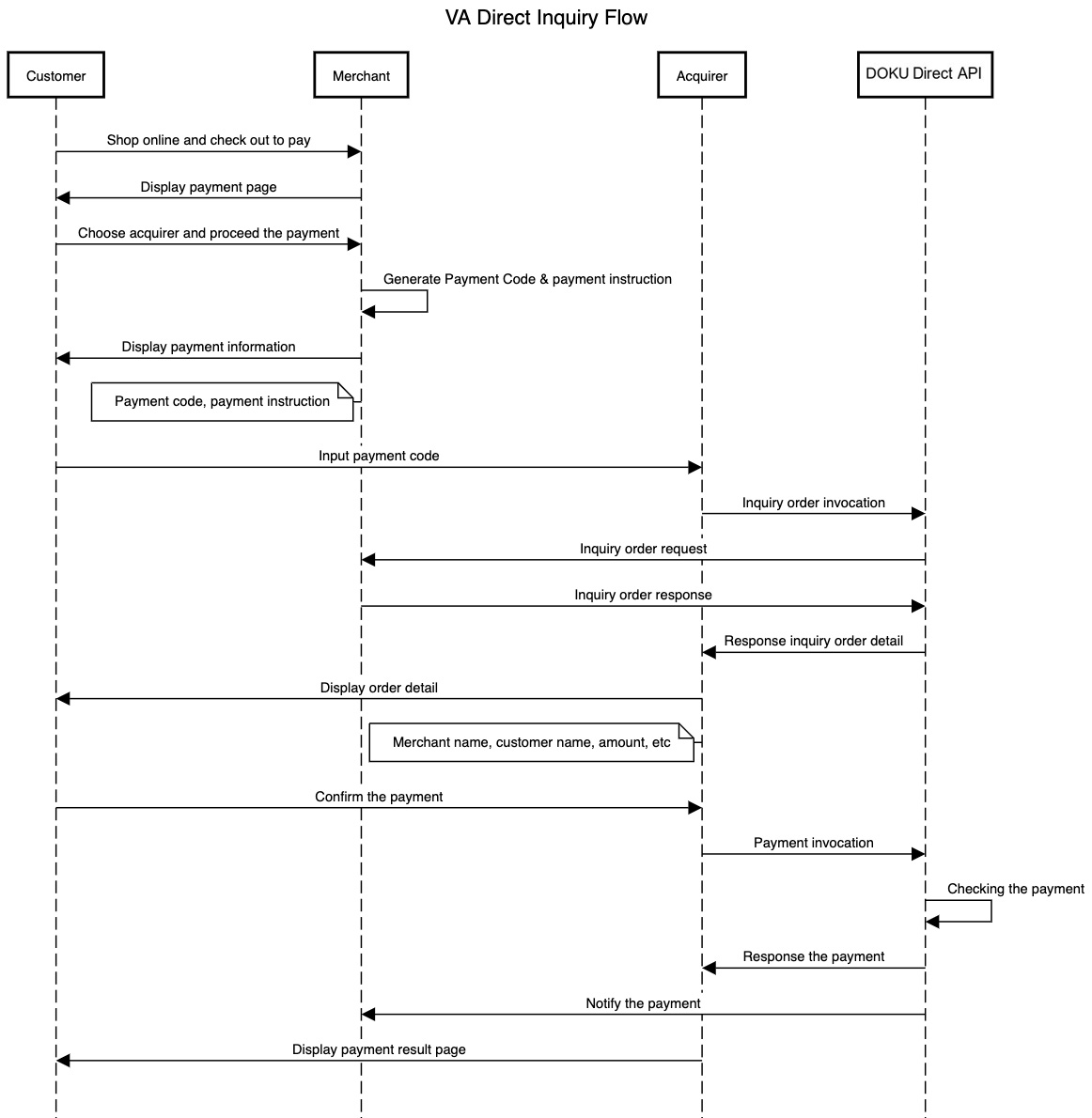

Direct API - Mandiri for Direct Inquiry Sequence Diagram

1. Setup Inquiry URL

To receive the inquiry request from DOKU. You must set your Inquiry URL to DOKU. Please contact our team for the setup.

Please inform the Inquiry URL for Sandbox environment and Production environment.

2. Generate Payment code

Generate payment is done in your system. The payment code length maximum is 16 digits.

3. Receive inquiry request from DOKU

API Request

DOKU will hits your Inquiry URL with the following API request:

| Type | Value |

|---|---|

| HTTP Method | POST |

Here is the sample of request header that DOKU generated for inquiry:

Client-Id: MCH-0001-10791114622547

Request-Id: 5b8e438f-fac1-4103-9e0e-ebfdc38b5acb

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from DOKU side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be verified on merchant Backend to ensure that the request is coming from DOKU. Please refer to this section to generate the signature |

Here is the sample of request body that DOKU will send to defined Inquiry URL:

{

"service": {

"id":"VIRTUAL_ACCOUNT"

},

"acquirer": {

"id":"BANK_MANDIRI"

},

"channel": {

"id":"VIRTUAL_ACCOUNT_BANK_MANDIRI"

},

"virtual_account_info": {

"virtual_account_number":"8896512345678123"

},

"virtual_account_inquiry": {

"date":"2020-08-11T08:45:42Z",

"identifier": [

{

"name": "TRACE_NUMBER",

"value": "100001"

},

{

"name": "TRANSACTION_NUMBER",

"value": "c1aa04bf421e5b38c3d18933e9994d3f289def65"

}

]

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

service.id | string | Mandatory | Value: VIRTUAL_ACCOUNT |

acquirer.id | string | Mandatory | Value: BANK_MANDIRI |

channel.id | string | Mandatory | Value: VIRTUAL_ACCOUNT_BANK_MANDIRI |

virtual_account_info.virtual_account_number | number | Mandatory | Virtual Account Number that is inquired by the customer |

virtual_account_inquiry.date | string | Mandatory | Timestamp request on UTC time in ISO8601 format |

virtual_account_inquiry.identifier | array | Optional | List of transaction identifier that coming from the acquiring. Merchant can save these data for reference |

API Response

After DOKU hits your Inquiry URL with the above API request, you must give the following response:

| Type | Value |

|---|---|

HTTP Status for virtual_account_inquiry.status = success | 200 |

HTTP Status for virtual_account_inquiry.status = decline | 400 |

HTTP Status for virtual_account_inquiry.status = billing_already_paid | 400 |

HTTP Status for virtual_account_inquiry.status = billing_was_expired | 400 |

HTTP Status for virtual_account_inquiry.status = billing_not_found | 404 |

HTTP Status for virtual_account_inquiry.status = invalid_signature | 401 |

Client-Id: MCH-0001-10791114622547

Request-Id: 5b8e438f-fac1-4103-9e0e-ebfdc38b5acb

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=9UPUFzOqJc47aJzD9ESOTcWg6TMsg3mqSP+DnUO8ENE=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from Merchant |

| Signature | Signature generated by Merchant based on the response body. Please refer to this section to generate the signature |

Here is the sample of response body:

{

"order": {

"invoice_number":"MINV20201231468",

"amount":150000

},

"virtual_account_info": {

"billing_type":"FIX_BILL",

"virtual_account_number":"8896512345678123",

"info1":"Thanks for shooping",

"info2":"Candi Store",

"info3":"Have a sweet day"

},

"virtual_account_inquiry": {

"status":"success"

},

"customer": {

"name":"Taufik Ismail",

"email":"taufik@doku.com"

}

"additional_info": {

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

order.invoice_number | string | Mandatory | Generated by merchant to identify the order and must unique per request Allowed chars: alphabetic, numeric, special chars Max length: 64 |

order.amount | number | Mandatory | In IDR currency and without decimal Allowed chars: numericMax length: 12 |

order.min_amount | number | Conditional | Send this parameter for Limited Amount Virtual Account to set the minimum amount need to be paid by the customer Allowed chars: numericMax length: 12 |

order.max_amount | number | Conditional | Send this parameter for Limited Amount Virtual Account to set the maximum amount need to be paid by the customer Allowed chars: numericMax length: 12 |

virtual_account_info.virtual_account_number | string | Mandatory | Same as the request |

virtual_account_info.billing_type | string | Optional | Generated by Merchant to implement the open amount, close amount and limit amount features. For open amount, set this to NO_BILL. For close amount, set this to FIX_BILLPossible Value : FIX_BILL, NO_BILL Default value: FIX_BILL |

virtual_account_info.info1 | string | Optional | Additional info that will be display on the acquirer channel when customer do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 32 |

virtual_account_info.info2 | string | Optional | Additional info that will be display on the acquirer channel when customer do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 32 |

virtual_account_info.info3 | string | Optional | Additional info that will be display on the acquirer channel when customer do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 32 |

virtual_account_inquiry.status | string | Mandatory | Possible value: success, decline, billing_already_paid, billing_was_expired, billing_not_found |

customer.name | string | Mandatory | Customer name that will be displayed on acquirer channel when do inquiry Allowed chars: alphabetic, numeric, special charsMax length: 64 |

customer.email | string | Optional | Customer email Allowed chars: alphabetic, numeric, special charsMax length: 128 |

additional_info | object | Optional | Merchant can send additional data through this parameter and will be get the data in the HTTP Notification |

4. Acknowledge payment result

After the payment is being made by your customer, DOKU will send HTTP Notification to your defined Notification URL. Learn how to handle the notification from DOKU:

Additional features

We provide various additional features to suited your needs. Learn more here.

Open amount virtual account

DOKU supports open amount payment meaning that your customer can input their own payment amount. To use open amount, you need to set virtual_account_info.billing_type = NO_BILL and you don't need to send order.amount to DOKU. Here is the sample:

{

...

"order": {

"invoice_number": "INV-20210124-0001",

...

},

"virtual_account_info": {

"billing_type": "NO_BILL",

...

},

...

}

Limit amount virtual account

DOKU supports limit amount payment meaning that your customer can input their own payment amount at the range that you defined. Limit amount only available when billing type is NO_BILL. To use limit amount, you need to set order.min_amount > 0 or order.max_amount > 0 to DOKU. Here is the sample:

{

...

"order": {

"invoice_number": "INV-20210124-0001",

"min_amount": 10000,

"max_amount": 50000,

...

},

"virtual_account_info": {

"billing_type": "NO_BILL",

...

},

...

}

Update and Cancel Virtual Account

If you wish to update your virtual account such as, update the amount, update the expiry time, customer details, and etc. You can do that by hitting the API with PATCH method:

API Request

| Type | Value |

|---|---|

| HTTP Method | PATCH |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/mandiri-virtual-account/v2/payment-code |

| API endpoint (Production) | https://api.doku.com/mandiri-virtual-account/v2/payment-code |

Here is the sample of request header to update payment code:

Client-Id: MCH-0001-10791114622547

Request-Id: 2dc5985e-adaa-4f82-b126-b09e9006da14

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to update payment code:

Cancel Virtual Account

To cancel a virtual account, simply set virtual_account_info.status to DELETE

{

"order": {

"invoice_number": "INV-20210124-0001",

"amount": 150000

},

"virtual_account_info": {

"virtual_account_number": "8889940000000213",

"status": "ACTIVE",

"expired_time": 60,

"reusable_status": false,

"info1": "Merchant Demo Store",

"info2": "Thank you for shopping",

"info3": "on our store"

},

"customer": {

"name": "Anton Budiman",

"email": "anton@example.com"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

order.invoice_number | string | Same as the generate VA request | |

order.amount | number | Conditional | Set this with updated value if wished. Set this parameter to more than (>) 0 for Close Amount Virtual AccountAllowed chars: numericMax length: 12 |

order.min_amount | number | Conditional | Set this with updated value if wished Allowed chars: numericMax length: 12 |

order.max_amount | number | Conditional | Set this with updated value if wished Allowed chars: numericMax length: 12 |

virtual_account_info.virtual_account_number | string | Mandatory | The virtual account number that wish to be updated |

virtual_account_info.status | string | Mandatory | Set ACTIVE to update the virtual account and set DELETE to cancel the virtual accountPossible value: ACTIVE, DELETE |

virtual_account_info.expired_time | number | Optional | Set this with updated value if wished Allowed chars: numericMaximum length: 5Default value: 60 |

virtual_account_info.reusable_status | number | Mandatory | Set this with updated value if wished Possible value: true false |

virtual_account_info.info1 | string | Optional | Set this with updated value if wished Allowed chars: alphabetic, numeric, special charsMax length: 32 |

virtual_account_info.info2 | string | Optional | Set this with updated value if wished Allowed chars: alphabetic, numeric, special charsMax length: 32 |

virtual_account_info.info3 | string | Optional | Set this with updated value if wished Allowed chars: alphabetic, numeric, special charsMax length: 32 |

customer.name | string | Mandatory | Set this with updated value if wished Allowed chars: alphabetic, numeric, special charsMax length: 64 |

customer.email | string | Optional | Set this with updated value if wished Allowed chars: alphabetic, numeric, special charsMax length: 128 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Client-Id: MCH-0001-10791114622547

Request-Id: 09e0defe-a071-45b3-9feb-ac134374628c

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=9UPUFzOqJc47aJzD9ESOTcWg6TMsg3mqSP+DnUO8ENE=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"order": {

"invoice_number": "INV-20210124-0001"

},

"virtual_account_info": {

"virtual_account_number": "8889940000000213",

"created_date": "20210331115005",

"expired_date": "20210331125005",

"created_date_utc": "2021-03-31T04:50:05Z",

"expired_date_utc": "2021-03-31T05:50:05Z"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

order.invoice_number | string | Mandatory | Same as the request |

virtual_account_info.virtual_account_number | string | Mandatory | Generated by DOKU that will be used by customer for doing a payment through acquirer channel (eg. ATM, Internet Banking) |

virtual_account_info.created_date | string | Conditional | Date time of VA generated with the format of yyyyMMddHHmmss. The created date uses UTC+7 time |

virtual_account_info.expired_date | string | Conditional | Date time of VA will be expired with the format of yyyyMMddHHmmss. The expired date uses UTC+7 time. Use this to set the expiry order on merchant side |

virtual_account_info.created_date_utc | string | Conditional | Date time of VA generated in UTC format |

virtual_account_info.expired_date_utc | string | Conditional | Date time of VA will be expired in UTC. Use this to set the expiry order on merchant side |

Split Settlement

If you are a platform or a marketplace, you can use this feature to settle the funds to your sellers or partners programmatically, save many operational efforts.

What's next?

You can test your payment through our Payment Simulator. Learn more here.