BRI Direct Debit Guide

DOKU has partnered with various banks and one of them is BRI to provide Direct Debit Payment. Learn more about how DOKU can help you integrate with BRI Direct Debit here.

Requirements

Before start integration, you must have retrieved credentials from BRI.

If you don't have the credentials yet, we can help to facilitate you to get one. Here is the flow to get BRI credentials:

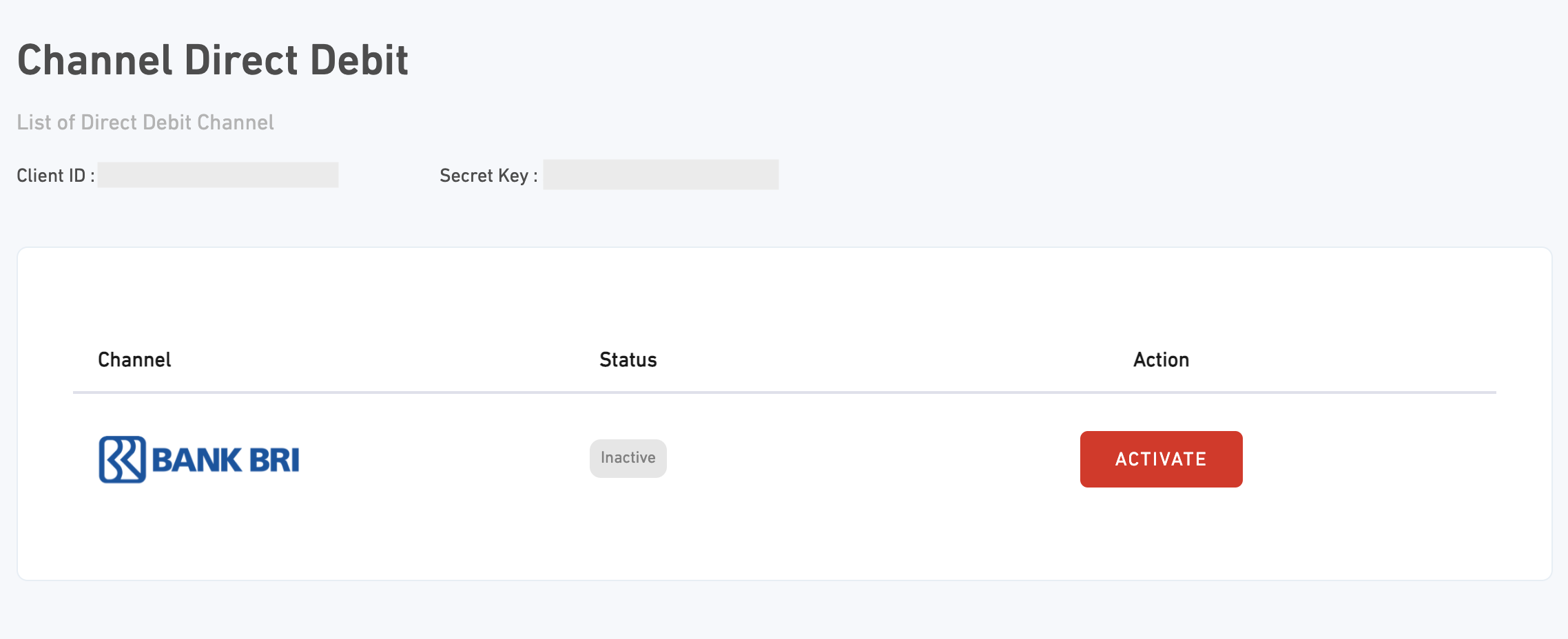

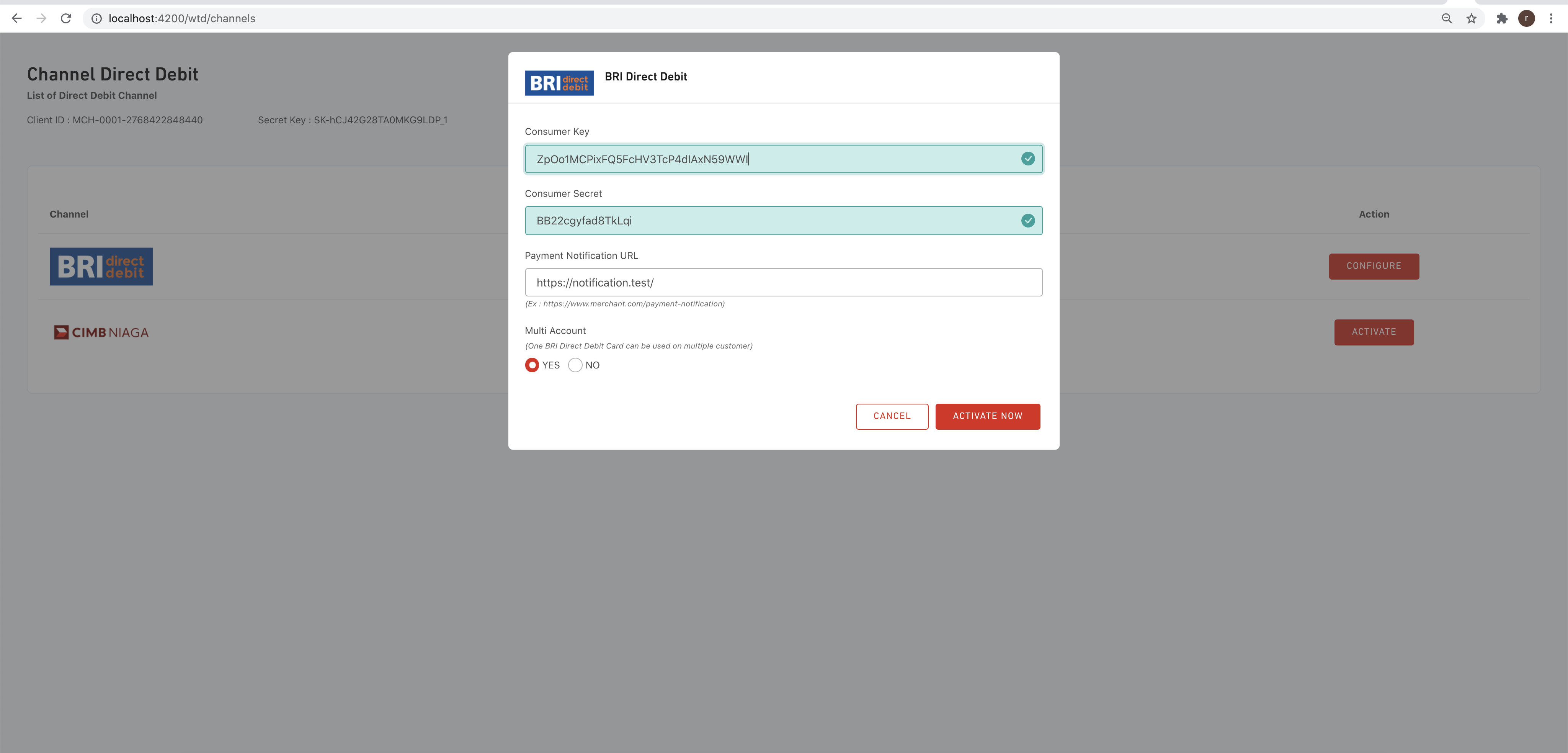

Direct API - BRI Direct Debit Activation

- Login to DOKU Back Office

- Go to Configuration > Direct Debit

- Select BRI Direct Debit and click Activate button

- Input

Consumer Key - Input

Consumer Secret - Click Activate button

Congratulations! You are now ready for the integration.

Integration steps

Here is the overview of how to integrate with Direct Debit:

- Register Debit card (tokenization)

- Get token list

- Create payment using the token

- Acknowledge payment result

Optional but recommended to have:

- Resend OTP for register card

- Resend OTP for payment

- Delete token

Advanced Features:

- Create a recurring payment

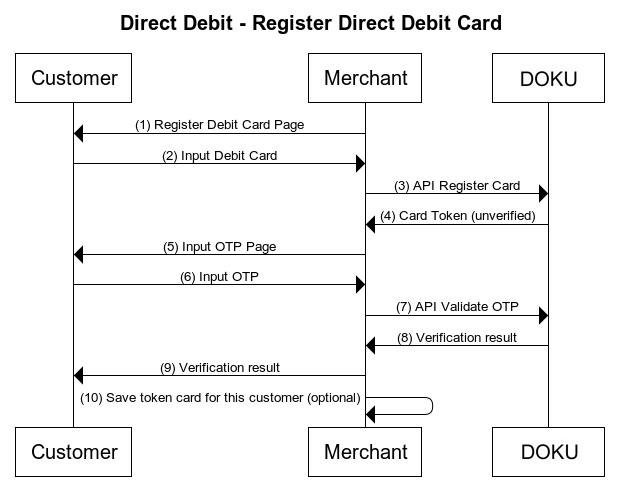

1. Register Debit card (tokenization)

Here is the flow for registering card:

Direct API - BRI Direct Debit Register Card Sequence Diagram

To register the card, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/direct-debit/v1/token |

| API endpoint (Production) | https://api.doku.com/direct-debit/v1/token |

Here is the sample of request header to register the debit card:

Client-Id: MCH-0001-10791114622547

Request-Id: 672118bb-9963-43ce-93b2-26d4fd0732a3

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to register the debit card:

{

"customer": {

"id": "CUST-0001",

"name": "Anton Budiman",

"email": "anton@example.com",

"phone": "6285694566147",

"address": "Menara Mulia Lantai 8",

"country": "ID",

"id_card": "182918299187776",

"date_of_birth": "15-12-1996"

},

"debit_card": {

"account_email": "anton@example.com",

"account_mobile_phone": "6286241451232",

"card_expiry": "0525",

"card_last_four": "8224",

"card_number": "12344567890"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Unique customer identifier generated by merchant. Required to generate payment token. Allowed chars: alphabetic, numeric, special charsMax Length: 50 |

customer.name | string | Optional | Customer name Allowed chars: alphabeticMax Length: 70 |

customer.email | string | Optional | Customer email Allowed chars: alphabetic, numeric, special charsMax Length: 255 |

customer.phone | string | Optional | Customer phone number. Format: {calling_code}{phone_number}. Example: 6281122334455Allowed chars: numericMax Length: 20 |

customer.address | string | Optional | Customer address Allowed chars: alphabetic, numeric, special charsMax Length: 255 |

customer.country | string | Optional | 2 alphabetic country code ISO 3166-1 Allowed chars: alphabeticMin-max Length: 60 |

customer.id_card | string | Optional | Customer Identity Card number (KTP) for our risk engine assessment Allowed chars: alphabetic, numeric, special charsMax length: 20 |

customer.date_of_birth | string | Optional | Customer date of birth for our risk engine assesment Format: dd-MM-yyyy |

debit_card.account_email | string | Conditional | Registered email on bank account (Mandatory and must be valid if use multiple account feature) |

debit_card.account_mobile_phone | string | Mandatory | Registered phone number on the BRI. Format: {calling_code}{phone_number}.Example: 6281122334455Max Length: 20 |

debit_card.card_expiry | string | Mandatory | Debit card expired date. Format: MMyy. Example the expiry date is February 2025, then the value is 0225 |

debit_card.card_last_four | string | Mandatory | Last 4 digit of the Debit Card number Max Length: 4 |

debit_card.card_number | string | Conditional | Card number, Mandatory if not send card_last_fourMax Length: 16 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 201 |

| Result | CREATED |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: 672118bb-9963-43ce-93b2-26d4fd0732a3

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"customer": {

"id": "CUST-0001",

"name": "Anton Budiman",

"email": "anton@example.com",

"phone": "6285694566147",

"address": "Menara Mulia Lantai 8",

"country": "ID",

"id_card": "182918299187776",

"date_of_birth": "15-12-1996"

},

"debit_card": {

"token_id": "243591d7e49f45109961581718c3ef82",

"status": "INACTIVE",

"message": "Waiting for validate OTP"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

customer.email | string | Optional | Same as the request |

customer.phone | string | Optional | Same as the request |

customer.address | string | Optional | Same as the request |

customer.country | string | Optional | Same as the request |

customer.id_card | string | Optional | Same as the request |

customer.date_of_birth | string | Optional | Same as the request |

debit_card.token_id | string | Mandatory | Token generated by DOKU for the Debit card to use when do payment Max length: 128 |

debit_card.status | string | Mandatory | Token status. In this state, it should be INACTIVE |

debit_card.message | string | Mandatory | The registration message |

1.1. Validate register Debit Card OTP

Maximum Retry OTP is 5 times

The customer only have 5 times maximum for retrying the OTP if the OTP they input is invalid. After that, the card will temporary blocked by the BRI for 24 hours.

Now the token is generated but the status is INACTIVE. BRI will send the OTP to the customers and you will need to provide the form to let the customer input the OTP.

To validate the OTP, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/direct-debit/v1/token/validate |

| API endpoint (Production) | https://api.doku.com/direct-debit/v1/token/validate |

Here is the sample of request header to validate the OTP:

Client-Id: MCH-0001-10791114622547

Request-Id: 4127892a-8b23-49d8-8277-c3b4fd1c786c

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to validate the OTP:

{

"debit_card": {

"token_id" : "243591d7e49f45109961581718c3ef82",

"otp" : "999999"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

debit_card.token_id | string | Mandatory | Token generated by DOKU for the Debit card to use when do payment Max length: 128 |

debit_card.otp | string | Mandatory | The Register Card OTP that sent by the BRI to the customer Max length: 6 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: 4127892a-8b23-49d8-8277-c3b4fd1c786c

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"debit_card": {

"token_id": "243591d7e49f45109961581718c3ef82",

"status": "SUCCESS",

"message": "Success Register Card"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

debit_card.token_id | string | Mandatory | Same as the request |

debit_card.status | string | Mandatory | Token status. In this state, it should be SUCCESS |

debit_card.message | string | Mandatory | The message to indicates the card has been registered (binded) |

2. Get token list

After the card is registered, you can show the token saved for your customer. This API also used to list down all the registered card, so that your customer does not need to register the card for the future payments.

To get the token list, you will to hit this API from your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/direct-debit/v1/tokens |

| API endpoint (Production) | https://api.doku.com/direct-debit/v1/tokens |

Here is the sample of request header to get the token list:

Client-Id: MCH-0001-10791114622547

Request-Id: 415f8064-ce1c-4c94-84b8-167201fd47cb

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to get the token list:

{

"customer": {

"id":"CUST-0001",

"name": "Anton Budiman"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | The customer ID that has been registered to DOKU Allowed chars: alphabetic, numeric, special charsMax Length: 50 |

customer.name | string | Optional | The customer name that has been registered to DOKU Allowed chars: alphabeticMax Length: 70 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: 415f8064-ce1c-4c94-84b8-167201fd47cb

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

[

{

"customer": {

"id": "CUST-0001",

"name": "Anton Budiman",

},

"debit_card": {

"token_id": "243591d7e49f45109961581718c3ef82",

"card_last_four": "8224"

}

}

]

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

debit_card.token_id | string | Mandatory | Token generated by DOKU for the Debit card to use when do payment Max length: 128 |

debit_card.card_last_four | string | Mandatory | Last 4 digit of the Debit Card number |

3. Create payment using the token

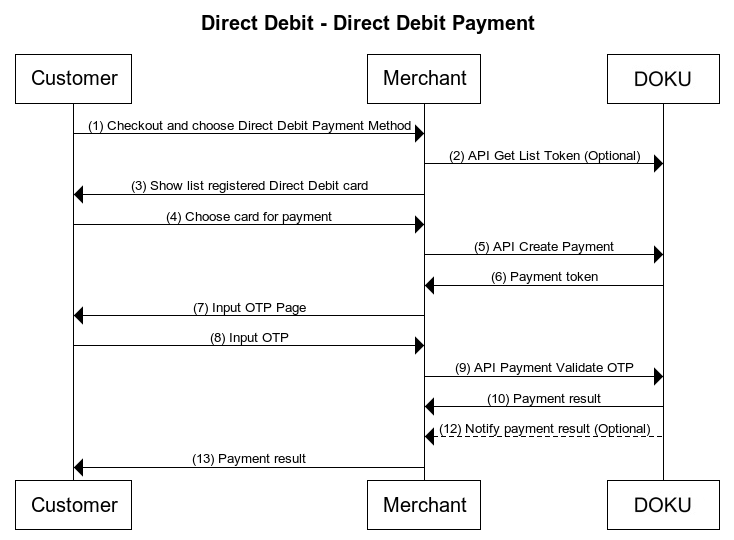

Here is the flow for creating payment using the token:

Direct API - BRI Direct Debit Payment Sequence Diagram

To create the payment, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/direct-debit/v1/payment |

| API endpoint (Production) | https://api.doku.com/direct-debit/v1/payment |

Here is the sample of request header to create the payment:

Client-Id: MCH-0001-10791114622547

Request-Id: b6a465ea-bb65-48b2-a22b-3e8fb51cf22e

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to create the payment:

{

"order": {

"amount": 90000,

"invoice_number": "INV-20210118-0001",

"line_items": [

{

"name": "T-Shirt Red",

"price": 30000,

"quantity": 2

},

{

"name": "Polo Navy",

"price": 30000,

"quantity": 1

}

]

},

"payment": {

"token_id": "243591d7e49f45109961581718c3ef82",

"otp_expiration_timestamp": 360010

},

"customer": {

"id": "CUST-0001",

"name": "Anton Budiman",

"email": "anton@example.com",

"phone": "6285694566147",

"address": "Menara Mulia Lantai 8",

"country": "ID",

"id_card": "182918299187776",

"date_of_birth": "15-12-1996"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | The customer ID that has been registered to DOKU Allowed chars: alphabetic, numeric, special charsMax Length: 50 |

customer.name | string | Optional | The customer name that has been registered to DOKU Allowed chars: alphabeticMax Length: 70 |

customer.email | string | Optional | Customer email Allowed chars: alphabetic, numeric, special charsMax Length: 64 |

customer.phone | string | Optional | Customer phone number. Format: {calling_code}{phone_number}. Example: 6281122334455Allowed chars: numericMax Length: 20 |

customer.address | string | Optional | Customer address Allowed chars: alphabetic, numeric, special charsMax Length: 255 |

customer.country | string | Optional | 2 alphabetic country code ISO 3166-1 Allowed chars: alphabeticMin-max Length: 60 |

customer.id_card | string | Optional | Customer Identity Card number (KTP) for our risk engine assessment Allowed chars: alphabetic, numeric, special charsMax length: 20 |

customer.date_of_birth | string | Optional | Customer date of birth for our risk engine assesment Format: dd-MM-yyyy |

order.amount | number | Mandatory | In IDR Currency and without decimal Allowed chars: numericMax length: 12 |

order.invoice_number | string | Mandatory | Generated by merchant to identify the order Allowed chars: alphabetic, numeric, special chars Max length: 64 |

order.line_items.name | string | Optional | Name of the product item Allowed chars: alphabetic, numeric, special chars |

order.line_items.price | number | Optional | Price of the product item. Total price and quantity must match with the order.amountAllowed chars: numeric |

order.line_items.quantity | number | Optional | Quantity of the product item Allowed chars: numeric |

payment.token_id | string | Mandatory | The token that will be use for this transaction Max length: 128 |

payment.otp_expiration_timestamp | number | Optional | OTP expiration time in minute Default: 10 minutes |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 201 |

| Result | CREATED |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: b6a465ea-bb65-48b2-a22b-3e8fb51cf22e

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"order": {

"invoice_number": "INV-20210118-0001",

"amount": 90000,

"line_items": [

{

"name": "T-Shirt Red",

"price": 30000,

"quantity": 2

},

{

"name": "Polo Navy",

"price": 30000,

"quantity": 1

}

]

},

"payment": {

"token": "kSooS93xUk6kJu9VuH33ec5QjlYxoNDEc+AfnoZYaB0=",

"status": "PENDING"

},

"customer": {

"id": "CUST-0001",

"name": "Anton Budiman",

"email": "anton@example.com",

"phone": "6285694566147",

"address": "Menara Mulia Lantai 8",

"country": "ID",

"id_card": "182918299187776",

"date_of_birth": "15-12-1996"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

customer.email | string | Optional | Same as the request |

customer.phone | string | Optional | Same as the request |

customer.address | string | Optional | Same as the request |

customer.country | string | Optional | Same as the request |

customer.id_card | string | Optional | Same as the request |

customer.date_of_birth | string | Optional | Same as the request |

order.amount | number | Mandatory | Same as the request |

order.invoice_number | string | Mandatory | Same as the request |

order.line_items.name | string | Optional | Same as the request |

order.line_items.price | number | Optional | Same as the request |

order.line_items.quantity | number | Optional | Same as the request |

payment.token | string | Mandatory | Payment token generated by DOKU specific for the transaction |

payment.status | string | Mandatory | Payment status. In this state, it should be PENDING |

3.1. Validate payment OTP

Maximum Retry OTP is 5 times

The customer only have 5 times maximum for retrying the OTP if the OTP they input is invalid. After that, the card will temporary blocked by the BRI for 24 hours.

Now the payment is created but the status is PENDING. BRI will send the OTP to the customers and you will need to provide the form to let the customer input the OTP.

To validate the OTP, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/direct-debit/v1/payment/validate |

| API endpoint (Production) | https://api.doku.com/direct-debit/v1/payment/validate |

Here is the sample of request header to validate the OTP:

Client-Id: MCH-0001-10791114622547

Request-Id: bce963fc-bb93-4ef2-948a-7838044b537e

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to validate the OTP:

{

"payment":{

"token": "kSooS93xUk6kJu9VuH33ec5QjlYxoNDEc+AfnoZYaB0=",

"otp": "999999"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

debit_card.token | string | Mandatory | The token that generated by DOKU for the transaction Max length: 128 |

debit_card.otp | string | Mandatory | The Payment OTP that sent by the BRI to the customer Max length: 6 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: bce963fc-bb93-4ef2-948a-7838044b537e

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"order": {

"invoice_number": "INV-20210118-0001",

"amount": 90000,

"line_items": [

{

"name": "T-Shirt Red",

"price": 30000,

"quantity": 2

},

{

"name": "Polo Navy",

"price": 30000,

"quantity": 1

}

]

},

"payment": {

"token": "kSooS93xUk6kJu9VuH33ec5QjlYxoNDEc+AfnoZYaB0=",

"status": "SUCCESS"

},

"customer": {

"id": "CUST-0001",

"name": "Anton Budiman",

"email": "anton@example.com",

"phone": "6285694566147",

"address": "Menara Mulia Lantai 8",

"country": "ID",

"id_card": "182918299187776",

"date_of_birth": "15-12-1996"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

customer.email | string | Optional | Same as the request |

customer.phone | string | Optional | Same as the request |

customer.address | string | Optional | Same as the request |

customer.country | string | Optional | Same as the request |

customer.id_card | string | Optional | Same as the request |

customer.date_of_birth | string | Optional | Same as the request |

order.amount | number | Mandatory | Same as the request |

order.invoice_number | string | Mandatory | Same as the request |

order.line_items.name | string | Optional | Same as the request |

order.line_items.price | number | Optional | Same as the request |

order.line_items.quantity | number | Optional | Same as the request |

payment.token | string | Mandatory | Same as the request |

payment.status | string | Mandatory | Payment status. In this state, it should be SUCCESS or FAILED |

4. Acknowledge payment result

After the payment is being made by your customer, DOKU will send HTTP Notification to your defined Notification URL. Learn how to handle the notification from DOKU:

Additional Features

These are the feature that recommended to implement to make sure that you deliver a good payment experience for your customers.

1. Resend OTP for register card

If for some reasons, your customers didn't receive the OTP when registering their card. You can use this API to resend new OTP.

To resend the new OTP for register card, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/direct-debit/v1/token-otp |

| API endpoint (Production) | https://api.doku.com/direct-debit/v1/token-otp |

Here is the sample of request header to resend the OTP for register card:

Client-Id: MCH-0001-10791114622547

Request-Id: 8b6758ee-167b-4253-916a-4ad06cbc898f

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to resend the OTP for register card:

{

"debit_card": {

"token_id": "243591d7e49f45109961581718c3ef82"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

debit_card.token_id | string | Mandatory | The token that generated by DOKU for the transaction Max length: 128 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: 8b6758ee-167b-4253-916a-4ad06cbc898f

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"debit_card": {

"token_id": "243591d7e49f45109961581718c3ef82"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

debit_card.token_id | string | Mandatory | Same as the request |

2. Resend OTP for payment

If for some reasons, your customers didn't receive the OTP when doing a payment. You can use this API to resend new OTP.

To resend the new OTP for payment, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/direct-debit/v1/payment-otp |

| API endpoint (Production) | https://api.doku.com/direct-debit/v1/payment-otp |

Here is the sample of request header to resend the OTP for payment:

Client-Id: MCH-0001-10791114622547

Request-Id: ea41603d-8f77-43ba-9dc3-def0766fe69b

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to resend the OTP for payment:

{

"payment": {

"token": "kSooS93xUk6kJu9VuH33ec5QjlYxoNDEc+AfnoZYaB0="

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

payment.token | string | Mandatory | Payment token generated by DOKU specific for the transaction. The token valid for 2.5 minutes |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: ea41603d-8f77-43ba-9dc3-def0766fe69b

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"payment": {

"token": "kSooS93xUk6kJu9VuH33ec5QjlYxoNDEc+AfnoZYaB0="

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

payment.token | string | Mandatory | Same as the request |

3. Delete the token

If for some reasons, your cutomers want to remove the card from your application, then you will need to provide this feature.

To delete the token, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/direct-debit/v1/token-delete |

| API endpoint (Production) | https://api.doku.com/direct-debit/v1/token-delete |

Here is the sample of request header to delete the token:

Client-Id: MCH-0001-10791114622547

Request-Id: c8154b5b-25fa-430d-9e5f-5a8a34d6d371

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to resend the OTP for payment:

{

"customer": {

"id": "CUST-0001",

"name": "Anton Budiman"

},

"debit_card": {

"token_id": "243591d7e49f45109961581718c3ef82"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | The customer ID that has been registered to DOKU Allowed chars: alphabetic, numeric, special charsMax Length: 50 |

customer.name | string | Optional | The customer name that has been registered to DOKU Allowed chars: alphabeticMax Length: 70 |

debit_card.token_id | string | Mandatory | Token generated by DOKU for the Debit card to use when do payment Max length: 128 |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 200 |

| Result | SUCCESS |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: c8154b5b-25fa-430d-9e5f-5a8a34d6d371

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"customer": {

"id": "CUST-0001",

"name": "Anton Budiman"

},

"debit_card": {

"token_id": "243591d7e49f45109961581718c3ef82",

"status": "SUCCESS",

"message": "Succes Unbinding Card"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

debit_card.token_id | string | Mandatory | Same as the request |

debit_card.status | string | Mandatory | The unbinding card status Possible value: SUCCESS, FAILED |

debit_card.message | string | Mandatory | The message to indicates that the card has been unbinded and merchant can safely revoke the card |

4. Recurring Payment

To create the recurring payment, you will need to hit this API through your Backend:

API Request

| Type | Value |

|---|---|

| HTTP Method | POST |

| API endpoint (Sandbox) | https://api-sandbox.doku.com/direct-debit/v1/payment-recurring |

| API endpoint (Production) | https://api.doku.com/direct-debit/v1/payment-recurring |

Here is the sample of request header to create the recurring payment:

Client-Id: MCH-0001-10791114622547

Request-Id: b6a465ea-bb65-48b2-a22b-3e8fb51cf22e

Request-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=vl9DBTX5KhEiXmnpOD0TSm8PYQknuHPdyHSTSc3W6Ps=

Request Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Client ID retrieved from DOKU Back Office |

| Request-Id | Unique random string (max 128 characters) generated from merchant side to protect duplicate request |

| Request-Timestamp | Timestamp request on UTC time in ISO8601 UTC+0 format. It means to proceed transaction on UTC+7 (WIB), merchant need to subtract time with 7. Ex: to proceed transaction on September 22th 2020 at 08:51:00 WIB, the timestamp should be 2020-09-22T01:51:00Z |

| Signature | Security parameter that needs to be generated on merchant Backend and placed to the header request to ensure that the request is coming from valid merchant. Please refer to this section to generate the signature |

Here is the sample of request body to create the recurring payment:

{

"customer": {

"id":"1232131321",

"name":"Jessica Tessalonika",

"email":"jessica@gmail.com",

"phone":"081287458232",

"id_card":"",

"country":"ID",

"address":"Jakarta, Menara Mulia Lt 8",

"date_of_birth":"08-09-1998",

"additional_info":""

},

"additional_info":{},

"order": {

"invoice_number":"MINV20201231468",

"line_items": [

{

"name": "bola",

"price": 10000,

"quantity": 1

},

{

"name": "ubi",

"price": 5000,

"quantity": 1

}

],

"amount": 15000,

"session_id":"session"

},

"payment": {

"token_id":"bcdbcdbcdbcbdbcdb-bcdbcd-bcdbcdb"

}

}

Request Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

customer.id | string | Mandatory | The customer ID that has been registered to DOKU Allowed chars: alphabetic, numeric, special charsMax Length: 50 |

customer.name | string | Optional | The customer name that has been registered to DOKU Allowed chars: alphabeticMax Length: 70 |

customer.email | string | Optional | Customer email Allowed chars: alphabetic, numeric, special charsMax Length: 64 |

customer.phone | string | Optional | Customer phone number. Format: {calling_code}{phone_number}. Example: 6281122334455Allowed chars: numericMax Length: 20 |

customer.address | string | Optional | Customer address Allowed chars: alphabetic, numeric, special charsMax Length: 255 |

customer.country | string | Optional | 2 alphabetic country code ISO 3166-1 Allowed chars: alphabeticMin-max Length: 60 |

customer.id_card | string | Optional | Customer Identity Card number (KTP) for our risk engine assessment Allowed chars: alphabetic, numeric, special charsMax length: 20 |

customer.date_of_birth | string | Optional | Customer date of birth for our risk engine assesment Format: dd-MM-yyyy |

customer.additional_info | string | Optional | Customer additional info |

additional_info | string | Optional | additional info |

order.amount | number | Mandatory | In IDR Currency and without decimal Allowed chars: numericMax length: 12 |

order.invoice_number | string | Mandatory | Generated by merchant to identify the order Allowed chars: alphabetic, numeric, special chars Max length: 64 |

order.line_items.name | string | Optional | Name of the product item Allowed chars: alphabetic, numeric, special chars |

order.line_items.price | number | Optional | Price of the product item. Total price and quantity must match with the order.amountAllowed chars: numeric |

order.line_items.quantity | number | Optional | Quantity of the product item Allowed chars: numeric |

order.session_id | string | Optional | Transaction session id |

payment.card_token | string | Mandatory | Token created from debit card data that linked to customer id (token id) |

API Response

After hitting the above API request, DOKU will give the response.

| Type | Value |

|---|---|

| HTTP Status | 201 |

| Result | CREATED |

Here is the sample response header:

Client-Id: MCH-0001-10791114622547

Request-Id: b6a465ea-bb65-48b2-a22b-3e8fb51cf22e

Response-Timestamp: 2020-08-11T08:45:42Z

Signature: HMACSHA256=1jap2tpgvWt83tG4J7IhEwUrwmMt71OaIk0oL0e6sPM=

Response Header Explanation

| Parameter | Description |

|---|---|

| Client-Id | Same as the request |

| Request-Id | Same as the request |

| Response-Timestamp | Timestamp Response on UTC with format ISO8601 UTC+0 from DOKU |

| Signature | Signature generated by DOKU based on the response body |

Here is the sample of response body:

{

"acquirer": {

"id":"BRI"

},

"customer": {

"id":"1232131321",

"name":"Jessica Tessalonika",

"email":"jessica@gmail.com",

"phone":"081287458232",

"id_card":"",

"country":"ID",

"address":"Jakarta, Menara Mulia Lt 8",

"date_of_birth":"",

"additional_info":""

},

"additional_info":{},

"order": {

"invoice_number":"MINV20201231468",

"line_items": [

{

"name": "bola",

"price": 10000,

"quantity": 1

},

{

"name": "ubi",

"price": 5000,

"quantity": 1

}

],

"amount": 15000,

"session_id":"session"

},

"payment": {

"payment_id":"123212313",

"token":"qweqweqwewqeqwdasdassad",

"status":"SUCCESS"

}

}

Response Body Explanation

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

acquirer.id | string | Mandatory | Bank Acquirer |

customer.id | string | Mandatory | Same as the request |

customer.name | string | Optional | Same as the request |

customer.email | string | Optional | Same as the request |

customer.phone | string | Optional | Same as the request |

customer.address | string | Optional | Same as the request |

customer.country | string | Optional | Same as the request |

customer.id_card | string | Optional | Same as the request |

customer.date_of_birth | string | Optional | Same as the request |

customer.additional_info | string | Optional | Same as the request |

additional_info | string | Optional | Same as the request |

order.amount | number | Mandatory | Same as the request |

order.invoice_number | string | Mandatory | Same as the request |

order.line_items.name | string | Optional | Same as the request |

order.line_items.price | number | Optional | Same as the request |

order.line_items.quantity | number | Optional | Same as the request |

order.session_id | string | Optional | Transaction session id |

payment.payment_id | string | Mandatory | Payment ID generated by Acquirer |

payment.token | string | Mandatory | Payment token generated by DOKU specific for the transaction |

payment.status | string | Mandatory | Payment status. In this state, it should be PENDING |

Tokenization

Want to make your checkout experience faster? You can combine this integration with the DOKU Token, so the next time your customer purchase, they don't need to input the debit card anymore.

Split Settlement

If you are a platform or a marketplace, you can use this feature to settle the funds to your sellers or partners programmatically, save many operational efforts.